Photo: iStockphoto.com.

Photo: iStockphoto.com.

You can't turn on the television these days without hearing about the economic crisis that's affecting not only the United States, but the entire world. So it stands to reason that many retirement funds are suffering as a result. Some public sector pension plans are relatively unaffected, while others were too fragile to weather the financial storm. Whether the safety of your retirement is in danger depends on the terms and stability of your pension fund, the health of your public employer's overall finances, and how long you have to make up any losses before you retire.

Chief Rob Bross of the Atwood (Ill.) Police Department is a part of a fully funded pension plan in Illinois, the Illinois Municipal Retirement Fund (IMRF). It's one of the reasons he left his previous job as chief at a much smaller Illinois police department that instead provided only a government-approved 401(k)-type plan for retirement that matched a small amount of contributions.

The man who was chief before Bross at that department lost $80,000 in the plan when the market took a dive during the Great Recession. He worked for a year and a half more than he'd intended to try to make it up, but it wasn't enough. Bross says the retired chief has now burned through most of his savings just paying his everyday bills. "With a guaranteed retirement such as IMRF, at least you're guaranteed you'll have x number of dollars every month," says Bross.

This is a good example of the two ends of the retirement spectrum right now in law enforcement. If you're vested in a well-funded defined benefit plan, your retirement is OK. If you don't have a defined benefit plan, or if yours is underfunded, the fate of your retirement is most likely up in the air right now as politicians, union reps, and financial experts develop a redesigned benefits package based on your public employer's current and projected finances.

The Blame Game

Monies for pension funds come from three sources: employee contributions, employer contributions, and return on investments. Employee contributions come out of your paycheck like clockwork. But anyone could tell you return on investments has been down since the Great Recession. And if an employer hasn't been paying its annual share, investments are no longer able to make up the difference as they had in the past. Therein lies the problem.

How did this happen, and who is being blamed? The list includes banks, small to large governments, unions, and police officers themselves.

Banks and other advisors that misled pension fund trustees have been sued by some funds. Wisconsin's Milwaukee County sued consulting company Mercer Inc. for $100 million in 2009 over what the county claims was bad advice regarding the amount of money lump sum "backdrop payments" to pensioners would cost. Out of a $45 million settlement, $13 million went to pay for attorneys' fees and $32 million was placed in the pension fund.

Similarly, the Police and Fire Retirement System of the City of Detroit sued Michigan real estate company Paramount Limited, LLC earlier this year over an alleged Ponzi scheme to recover funds owed from a defaulted $9.9 million loan.

Danger of such financial missteps is why James McNamee established the Illinois Public Pension Fund Association in 1983, while he was serving as a police officer with the Barrington (Ill.) Police Department. When he was elected to the Barrington Police Pension Board, he discovered there was no training or education for trustees of the fund like himself.

McNamee currently serves as president of the association he founded to provide training to its members, which has grown from 50 to 400 pension funds. He's also helped to establish standard pension board policies and procedures, and has helped implement legislative changes as well as help to review the performance of investment managers and consultants.[PAGEBREAK]

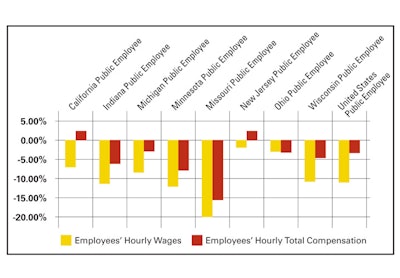

This chart shows public employees' wages and compensation as compared to that of their private sector counterparts. Source: Employment Policy Research Network.

This chart shows public employees' wages and compensation as compared to that of their private sector counterparts. Source: Employment Policy Research Network.

"The vast majority of public sector pension plans are well funded," assures Hank Kim, executive director of the National Conference on Public Employee Retirement Systems (NCPERS). "For the few that are the headline-grabbing examples of underfunded pensions, the cause of that underfunding stems from the fact that plan sponsors have not made their contributions to the pension plan."

Apparently not all pension boards are as well informed as the members of McNamee's association. Some of the problems of underfunded pensions could be due to poor financial planning and management by trustees and consultants who lacked knowledge. But that's not true for every case.

"There is a crisis, but it's been manufactured in large part to cover up the fiscal mismanagement of elected officials over several generations," says Jim Pasco, executive director of the National Fraternal Order of Police. "As economic times deteriorated, elected officials suddenly found themselves pinched for cash, and they developed buyer's remorse over the contracts they and their predecessors over time had entered into. Now all of a sudden it's seen as the fault of the greedy public servant that there was a fiscal crisis in these communities."

The real problem for many underfunded pensions is lack of employer contributions over time—a long time—that's coming to a head now because of the dip in the market. No one knew when this would happen, but the public employers that failed to make their yearly contributions did so intentionally.

"In Illinois, under our former governor Rod Blagojevich, the state made zero contributions to the state's pension funds, what Blagojevich called a 'pension holiday,'" says Sean Smoot, director and chief legal counsel for the Police Benevolent and Protective Association of Illinois. "It was a notorious thing that he did."

Blagojevich's government wasn't the only one to take a "pension holiday." In fact, Milwaukee's pension fund had been so well funded up until 2009 that the city of Milwaukee hadn't contributed in two years. The mayor and city council dipped into a reserve fund that had been created to help cover the costs when both the city and county were required to cover the loss of one-third of its pension funding because of the down market.

Now many police officers and other public safety professionals are left wondering why they're getting punished for someone else's bad decisions.

Drastic Measures

Rhode Island is one state facing a major problem with underfunded pension funds. And it's looking to make major changes to come up with some sort of solution. Officials are looking at reducing benefits, lowering retirement payments, replacing part of the pensions with 401(k)-type accounts, and reducing retirees' cost-of-living increases.

If you're grandfathered in to a pension system, you might be safe. And if your state has in its constitution that it can't renege on pension promises, you're in a better position. But with too little money on hand and few other options, states like Rhode Island that are faced with severely underfunded pensions are less afraid of potential legal recourse from unions and other interested parties.

States are now cutting into current retirees' pension benefits to stay afloat-something thought unthinkable until recently. South Dakota, Colorado, Minnesota, New Jersey, and Maine have all reduced cost-of-living increases for their retirees. But there are other measures that can generally be taken before taking that step.

"If a pension plan has systemic, long-term funding issues, employers could contribute more, employees could contribute more, they could change some of the multipliers, they could change the retirement age," says NCPERS' Kim. "If there's collective bargaining, if there's constitutional protections for the promises made, those things need to be worked out sitting across the table from each other to negotiate on."

Having taken a drastic measure to solve its financial woes, the city of Vallejo, Calif., is emerging from bankruptcy protection after three years. It decreased its police department by 47 percent, but it couldn't alter the pensions of police officers who were already retired because of a California law. "But we could increase what employees are asked to pay and the cost of their medical," Vallejo's city manager Phil Batchelor told local station WPRI. "All of those were made possible because of the bankruptcy proceeding."

The Vallejo Police Officer Association and other city unions fought the changes, but are now making concessions, especially after the city is out the money spent on legal fees, further draining the public coffers.[PAGEBREAK]

Recently filing for Chapter 9 themselves, officials in Central Falls, R.I., plan to emerge from bankruptcy within six months and avoid the drawn-out proceedings that have plagued Vallejo. Central Falls has already cut the checks of its retired police officers in half. It's the first city in its state to file for bankruptcy, but it might not be the last.

In the Rhode Island town of Cranston, each of the city's 172 retired police officers on pensions is receiving only $5,000 less per year than its 109 active police officers. That's a big drain on the budget, and the city can't sustain the system as is.

Tier Systems

The way most underfunded pension plans are making changes is through the use of "tiers." Anyone hired after a certain date falls into a different "tier" and gets a modified retirement package that doesn't provide as many benefits as that of other law enforcement officers already in the pension plan.

Currently, the IMRF is fully funded, even though the state of Illinois has major funding concerns. This was possible because the employers, not the state, contribute to the fund. And these employers always make their contributions because they're required to by law, and that mandate is enforced.

"There have been a number of places, including Illinois, where they have devised a second tier. New York City, which has a history of modifying plans for new hires, is on Tier 6," says Smoot. "There's a momentum to do that right now."

Experts say the combination of a fully functioning funding system and a tier system that adjusts benefits for new hires keeps spending at a sustainable level.

"One of the best models of pension funding is the funding model in the Illinois Municipal Retirement Fund (IMRF)," says Smoot. "Under IMRF, employees contribute a set percentage amount of their salary, and IMRF sends the public employer a bill for whatever their contribution share is. And if the city or county doesn't pay their bill, the state comptroller withholds that amount of their share of their tax money and pays the pension fund."

But most other pension funds in Illinois have problems, which affects state troopers and other police officers. The five major state public pension funds are underfunded by around $80 billion total, with the best being only 46 percent funded. And those problems could end up affecting everyone if there isn't enough money available.

Chief Bross of the Atwood (Ill.) PD is thankful that his previous employment with a sheriff's office allowed him to qualify as part of Tier 1 in the IMRF. Otherwise, he would be lumped in with others who were hired on to member agencies after Jan. 1, 2011, and receive lesser benefits as a part of Tier 2.

"With Tier 1, which is much better, you can take early retirement at 55, and as long as you're 20 years in, you're collecting half of the average of your last three or four years' salary," says Bross. "With Tier 2, I believe it's the average of your last five years and early out is 62 [years of age]."

Los Angeles Police Department officers also have a new tier. Instead of paying eight or nine percent of their salary toward their pension, employees in the new tier must pay 11 percent, in addition to paying for retirees' healthcare for the first time, according to Paul M. Weber, the president of the Los Angeles Police Protective League and a sergeant with the LAPD.

These changes for new hires are small adjustments compared to other proposals for solving funding problems. When asked about the prospect of officers having only 401(k)s, or defined contribution plans that depend solely on the market, instead of guaranteed pensions, Bross is skeptical. "I think you're going to find that hard," he says. "You might be able to do it with the non-union officers, but really I don't see the FOP letting that fly."[PAGEBREAK]

Pasco emphatically agrees. "Going from defined benefit to defined contribution? We don't see that as a good option."

Unions across the country are fighting proposed changes to law enforcement officers' pensions. But they still have to work with the money that's available.

"We understand that if the money is not there, notwithstanding the fact that it's not there because of the incompetence of elected officials, then we will negotiate in good faith to assist the municipality in getting back onto an even keel," says Pasco, speaking for the FOP. "But we will not let public officials paint their crisis as being the result of greedy police officers or take away everything that police officers and police unions have fought so hard to get over the years in a broad spectrum effort to make everyone happy."

A Social Contract

Pensions and other benefits law enforcement officers receive are meant to be compensation for a very tough job. It's often physically demanding, stressful, and mentally and emotionally exhausting. All of this takes a toll and makes it difficult to stay on the job after a certain age.

"I think for a lot of people in the profession, there is a social contract between citizens and them," says Weber. "If something happens to me, my family is going to be taken care of. Or if I'm shot and paralyzed I'll be cared for. Or if I manage to come out of service in one piece, there's a pension at the end. That's what it comes down to."

So what happens if that social contract is no longer honored, if those benefits are no longer offered?

"I think two groups of people should be concerned: public employers and those considering entering employment with a public employer," warns Smoot.

Public employers, including police agencies, are going to have even more difficulty than they do now attracting and retaining qualified employees. Some of those who would like to join law enforcement will do so and receive fewer benefits as police officers, but they might end up leaving after just a few years once they decide it's not worth it. Others are just going to choose other careers instead at the outset.

"If you're the only ones hiring in the state of California, which we were for a while, and you still see a 30 percent decrease in applications, that's got to tell you something," says Weber of the LAPD's situation.

And lowering standards to accept more applications from a smaller pool of candidates to fill jobs is not a viable option. "Lowering standards proves disastrous," cautions Weber. "You need good people to do this job. There is no room for error."

Of course, reducing benefits doesn't affect just young people. Officers already on the job as well as those who are new hires now could eventually find themselves working past their prime-mentally or physically-just to pay the bills, and then it becomes a liability issue. "You don't want an officer to have a serious injury or be killed because the only reason he's working is because he can't afford to retire," says Bross. Such a situation would affect police officers, their employers, and of course the public they serve.

The Pension Problem

It appears it's not the pension system as a whole that needs to be reformed. The problem is in public employers' not following through on what was promised as part of the plan-whether they knowingly made promises they couldn't keep or decided later they didn't want to keep them. What experts say public employee pension programs really need is reform in the enforcement of pension contributions by governments. There are plenty of fully funded, fully functioning pension funds that provide for public employees' retirement.

Most Americans who comprise the taxpaying public have little if any retirement and no guaranteed pension programs. So one reason they can take issue with public pensions is that they're jealous of those benefits that their 401(k)s and other investments can't match. But there's a contingent working to provide a solution.

"I think the larger theme is instead of looking at the public sector pension system as a villain, I think we ought to look at the larger picture of retirement security for all Americans," says Kim. "If we don't start addressing it now, then in 15 to 20 years when the bulk of the baby boomers are retired, we're going to have serious social welfare issues that we're going to have to deal with."

Weber agrees, and he believes the public sector has the answer to this problem, if only people would listen. "The discussion we need to have is how do we as a country get back to the defined benefit plan, which when properly run and properly administered guarantees a lifelong secure benefit that someone can count on, and that is more cost effective than a 401(k)," says Weber.

As for the currently underfunded pensions law enforcement officers depend on, there is some hope that things could turn around and retirement packages could improve again. Some pension funds that were once in trouble are now fully funded. And the benefits IMRF now provides are better than they were 25 years ago, for example.

It doesn't look like defined benefit plans are going away, and yours may be fully funded and fine. But that doesn't mean you shouldn't keep on top of your pension's funding and benefits, and save and budget accordingly so you won't be left twisting in the wind if you hit retirement age and your pension isn't as secure as you'd hoped...or been promised it would be.

Related: