Photo: Wendy Dutenhoeffer

Photo: Wendy Dutenhoeffer

We've all seen them, and sometimes shared a good chuckle over their contents. Some are so funny they're featured on the Tonight Show with Jay Leno. Most are abandoned, neglected, and ignored. Sometimes they are skimmed as a last resort or used only as a troubleshooting reference.

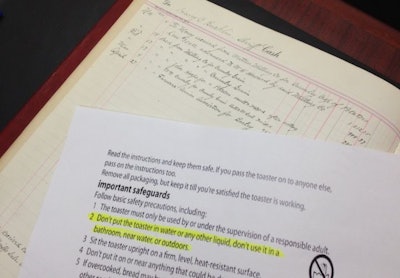

What the heck am I talking about? Instruction booklets. I'm as guilty as the next person. I get a shiny new toaster, rip open the box, and toss the instructions aside, "Instructions? I don't need no stinkin' instructions!"

Why is it that these booklets are banished to the land of misfit toys? Well, quite frankly, because they are boring and usually poorly written. Something is lost in the translation from Mandarin to English and the book says to, "Butter your car after it extrudes up from the toasting chamber." The best part of these little gems are using found in the front section entitled, "Caution, Read Before First Use." This section customarily contains warnings about how notto use your new appliance:

- "Do not make toast while in the bathtub."

- "Do not submerge plugged-in appliances."

- "Do not plug in an appliance, which is submerged."

- "Do not stab exposed electrical wires with a chef's knife."

I can hear you thinking, "Seriously? Are people that stupid?" Sadly, the answer is yes. A person at some point in time tried to use their toaster as a submarine and got hurt. So now the Toast It All Company has to include this language to prevent them from getting sued. Of course, I probably don't have to tell you any of this. As a law enforcement officer, you have seen plenty of stupid in action.

The world of finance has its own instruction booklets. The main one is called Generally Accepted Accounting Principles, or GAAP. There are also instruction books from the Internal Revenue Service (IRS) and the Securities and Exchange Commission (SEC). If that isn't enough, most organizations have their own policies and procedures. There are best practices for finance and accounting. And, yes, these are all incredibly boring and extremely cumbersome.

Like the smirks and comments made about the toaster instructions, there are plenty of sarcastic comments available for finance, accounting, budgets and purchasing procedures. Please let me assure you, as boring as these "instruction books" may be, they are for your own protection. It's their goal to keep you from dropping your "financial toaster" in a tub of hot, greasy, water.

Not convinced? Are you still certain that the accounting folks in your department exist for no other purpose than to make your life miserable? I mean, really, why can't you just go buy what you need to get your job done? Why do you need to fill out all this paperwork and get signatures? Whether you believe it or not, these checks and balances are in place for your safety as well as the protection of others.

Still not convinced? Look up the history of a little company called Enron. They didn't like how the accounting rules made their company look, so they created a web of deception so tangled their own insiders couldn't figure it out. Man, they looked good on paper, though. Enron is the person who plugged in the submerged toaster. Their deceptive actions, intentional or not, resulted in the addition of several new sections to the GAAP and SEC regulations. Beyond inscribing the death sentence for hundreds of trees Enron was also responsible for huge investor losses and employee job losses. Thousands lost their savings and retirement. They were also responsible for the collapse of the 89-year-old accounting firm of Arthur Andersen.

Fast forward to current day and take a look at the headlines affecting public employees and elected or appointed officials. Every day a new city or county is claiming or talking about claiming bankruptcy. Salaries of peace officers, firefighters, and teachers are being slashed. Benefits and retirement packages are threatened. With military-like precision, all fingers snap to attention and point to those in charge of finances. "Financial mismanagement" is screamed from the rooftops! "There weren't enough checks and balances," "Policies and procedures were ignored." The public demands an audit, "Someone must pay!" These statements are electrical currents running through water in the tub; somebody is going to get hurt.

If you oversee budgets or approve purchases, I have a plea for you. Please, please, please take the time to talk to your agency's finance person. Hopefully, they are not as boring as the toaster instruction book, and they will guide you through every step, every check and every balance. They are your friend, your guide, your teammate. They can show you how important it is to take the time to verify invoice amounts are correct, that invoices match contract amounts, and that you have received the goods or services listed.

Your financial officer can let you know that if you just throw your initials on an invoice, the accounting office will process it under the assumption you've verified it correctness and process it for payment. It is not a clerk's job to approve a department's expenses. Think I'm talking crazy? Well, I recently read about city where invoices were approved in the direct contrast with the contract amount for over 17 years! You guessed it; the public is crying financial mismanagement.

Public officials, I have a special plea for you. I urge you do not negate financial advice or policies. You may feel the accounting rules are an attempt to manipulate and control your department, but they are there for your protection.

When you "push-through" a purchase without the proper paperwork and the purchase is against best practices, you're putting yourself and every person in your department at risk. When you are inconsistent and demand approvals on some purchases, but pay others without a second glance, you are showing your employees that the rules don't matter. In law enforcement that's a bad precedent because the rules are our business.

When you agree to pre-pay several thousand dollars to a company out of the country and against financial advice as well as violating best practices, are you acting in the best interest of all the souls for which you are responsible? How will you answer to the public if the company takes their money and never delivers a product? Ask yourself this question, "will my department pass a forensic audit?"

Wendy Dutenhoeffer is a financial officer with the Bonneville County (Idaho) Sheriff's Office with 22 years of experience in finance.

Related:

Stretching Your Budget In a Recession